Environmental, Social and Governance (ESG) Principles

- Vox adheres to a very disciplined approach to Environmental, Social and Governance (ESG) Principles when evaluating new royalty investments.

- Vox is committed to furthering sustainable development in the mining and metals industry through its investments and seeks to employ ESG best practice through the company’s due diligence process that guides its investment decisions.

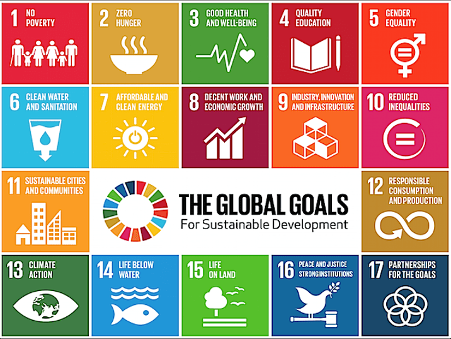

- The Vox management team and Investment Committee evaluates every new royalty investment with ESG principles that are aligned with Ten Principles of the United Nations Global Compact on human rights, labour, environment and anti-corruption.

- Vox is committed to making the UN Global Compact and its principles part of the strategy, culture and day-to-day operations of our company, and to engaging in collaborative projects which advance the broader development goals of the United Nations, particularly the Sustainable Development Goals.

- Vox is in the business of providing liquidity events to royalty-holding prospectors and companies in the mining sector — principally through royalty transactions. These liquidity events enable prospectors and resource companies to further the exploration, development and operations at mining properties. Our business is unique in the mining industry as it reflects both indirect exposure to ESG issues from mining operations and direct exposure to ESG factors in the day-to-day corporate environment.

- Vox drives shareholder value by realizing long-term investment opportunities in mining assets. In many cases our royalties outlive the current developers or operators of the asset, so we imagine not only how a mine functions under current management and conditions but how it will operate under future operators and markets. ESG factors play a central role in determining the success of a long-term mining investment. Vox’s strategy to mitigate ESG risks involves a thorough investigation and evaluation of the risk factors related to a mineral property and its current operator prior to an investment. While in almost all instances Vox has no direct control over a project or the various ESG risks associated with a mine, we recognize that a mine that functions safely, successfully, and with multi-generational support of local communities and governments is more likely to result in a good investment than a mine that cannot achieve these objectives.

- Vox’s management team applies a multi-disciplinary approach when evaluating potential transactions. In addition to relying on management’s expertise, Vox benefits from the experience and expertise of its Board of Directors. Board members are active in the review of potential material investments including participation in due diligence and providing technical, operational, political, financial, environmental, corporate social responsibility, and other expertise where applicable. The due diligence team consists of professionals with experience and expertise in the fields of geology, mining, engineering, legal/regulatory and finance. By conducting a robust and detailed due diligence process, Vox endeavours to invest in projects with relatively low ESG risk. Where appropriate, the due diligence process involves, among other things, thorough desktop studies, the engagement of expert consultants, extensive interviews with the project management team, site visits, as well as in-depth internal deliberation. The due diligence process may vary depending on the project's stage of development and the materiality of the investment to Vox. Vox will determine if an investment should be made based on overall criteria, including ESG factors. The overall criteria are reviewed regularly by management and/or the Board of Directors where applicable.